Granville Ohio Income Tax Rate . Ohio state income tax brackets depend on taxable income and residency status. 0%, 2.75%, 3.68% and 3.75%. Census data for granville, oh (pop. In may 2023, the district renewed the 5 year.75% traditional income tax levy. Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. The state has four tax rates: These rates are for income earned in. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. Granville residents must report 100% of. 5,778), including age, race, sex, income, poverty, marital status, education and more.

from www.chegg.com

Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. 5,778), including age, race, sex, income, poverty, marital status, education and more. Granville residents must report 100% of. The state has four tax rates: Ohio state income tax brackets depend on taxable income and residency status. In may 2023, the district renewed the 5 year.75% traditional income tax levy. 0%, 2.75%, 3.68% and 3.75%. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. These rates are for income earned in. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax.

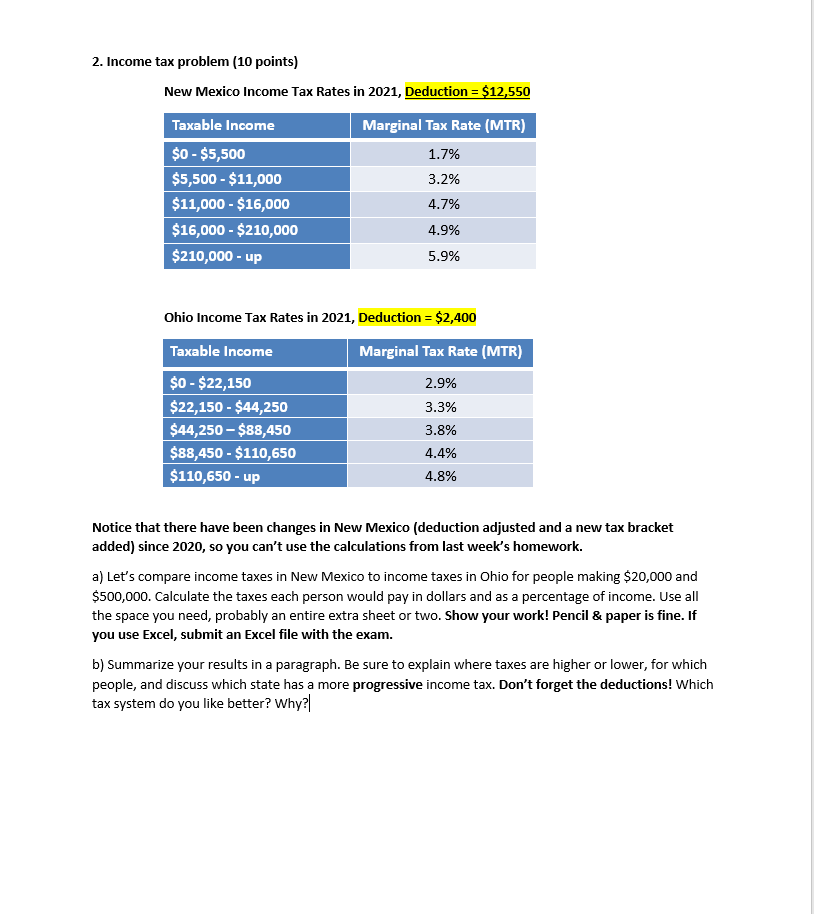

Solved New Mexico Tax Rates in 2021, Deduction

Granville Ohio Income Tax Rate The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Ohio state income tax brackets depend on taxable income and residency status. Granville residents must report 100% of. In may 2023, the district renewed the 5 year.75% traditional income tax levy. 0%, 2.75%, 3.68% and 3.75%. Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. These rates are for income earned in. 5,778), including age, race, sex, income, poverty, marital status, education and more. The state has four tax rates: Census data for granville, oh (pop.

From www.granville.oh.us

Village of Granville Granville Ohio Income Tax Rate 5,778), including age, race, sex, income, poverty, marital status, education and more. 0%, 2.75%, 3.68% and 3.75%. Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. The village of granville will follow the federal and state of ohio in extending the due date for all granville income. Granville Ohio Income Tax Rate.

From www.policymattersohio.org

Ohio state and local taxes hit poor and families the hardest Granville Ohio Income Tax Rate 0%, 2.75%, 3.68% and 3.75%. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. In may 2023, the district renewed the 5 year.75% traditional income. Granville Ohio Income Tax Rate.

From printableformsfree.com

Ohio State Tax Fillable Form Printable Forms Free Online Granville Ohio Income Tax Rate Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. Ohio state income tax brackets depend on taxable income and residency status. The state has four. Granville Ohio Income Tax Rate.

From financesyrup.com

Tax Rates for Ohio 2023 Granville Ohio Income Tax Rate The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. These rates are for income earned in. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. 5,778), including age, race, sex, income, poverty, marital status, education and more.. Granville Ohio Income Tax Rate.

From shawntracee.pages.dev

2024 Per Diem Rates California Abby Linnea Granville Ohio Income Tax Rate The state has four tax rates: The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. 5,778), including age, race, sex, income, poverty, marital status, education and more. These rates are for income earned in. 0%, 2.75%, 3.68% and 3.75%. In may 2023, the district renewed the 5 year.75% traditional income. Granville Ohio Income Tax Rate.

From innovationohio.org

Policy makers continue to make tax code in Ohio more regressive Granville Ohio Income Tax Rate The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. Ohio state income tax brackets depend on taxable income and residency status. In may 2023, the district renewed the 5 year.75% traditional income tax levy. The state has four tax rates: Census data for granville, oh (pop. The. Granville Ohio Income Tax Rate.

From www.scribd.com

Sales Tax Rates by County in Ohio PDF Ohio The United States Granville Ohio Income Tax Rate Census data for granville, oh (pop. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. These rates are for income earned in. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. Granville residents must report 100% of.. Granville Ohio Income Tax Rate.

From www.cleveland.com

Ohioans are spending more money on taxable things this year, including Granville Ohio Income Tax Rate 5,778), including age, race, sex, income, poverty, marital status, education and more. Granville residents must report 100% of. 0%, 2.75%, 3.68% and 3.75%. Ohio state income tax brackets depend on taxable income and residency status. In may 2023, the district renewed the 5 year.75% traditional income tax levy. The village of granville will follow the federal and state of ohio. Granville Ohio Income Tax Rate.

From ronnyqpammie.pages.dev

Ohio Tax Rate 2024 Ivett Letisha Granville Ohio Income Tax Rate The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The state has four tax rates: Ohio state income tax brackets depend on taxable income and residency status. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. In. Granville Ohio Income Tax Rate.

From www.chegg.com

Solved New Mexico Tax Rates in 2021, Deduction Granville Ohio Income Tax Rate The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. 5,778), including age, race, sex, income, poverty, marital status, education and more. Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. 0%, 2.75%, 3.68% and 3.75%. The state. Granville Ohio Income Tax Rate.

From www.uslegalforms.com

OH Tax Return Bryan City 20182022 Fill and Sign Printable Granville Ohio Income Tax Rate Ohio state income tax brackets depend on taxable income and residency status. 0%, 2.75%, 3.68% and 3.75%. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. These rates are for income earned in. In may 2023, the district renewed the 5 year.75% traditional income tax levy. The village of granville. Granville Ohio Income Tax Rate.

From tessimahala.pages.dev

Ohio Tax Day 2024 Efile Clio Melody Granville Ohio Income Tax Rate Ohio state income tax brackets depend on taxable income and residency status. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. 5,778), including age, race, sex, income, poverty,. Granville Ohio Income Tax Rate.

From www.taxuni.com

Fed Interest Rate Granville Ohio Income Tax Rate Ohio state income tax brackets depend on taxable income and residency status. 5,778), including age, race, sex, income, poverty, marital status, education and more. The state has four tax rates: Census data for granville, oh (pop. Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. 0%, 2.75%,. Granville Ohio Income Tax Rate.

From imagetou.com

Tax Rates 2024 2025 Image to u Granville Ohio Income Tax Rate Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. In may 2023, the district renewed the 5 year.75% traditional income tax levy. 5,778), including age, race, sex, income, poverty, marital status, education and more. The finder, from the ohio department of taxation, provides information on local taxing. Granville Ohio Income Tax Rate.

From www.chegg.com

Solved 2. tax problem ( 10 points) New Mexico Granville Ohio Income Tax Rate Browse the granville, oh property tax rates on our tax rates tables and learn more about foreign tax credits and payroll taxes. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. These rates are for income earned in. Census data for granville, oh (pop. 0%, 2.75%, 3.68% and 3.75%. Ohio. Granville Ohio Income Tax Rate.

From www.formsbank.com

Village Of Granville Tax Department Claim For Refund Form Granville Ohio Income Tax Rate Granville residents must report 100% of. 5,778), including age, race, sex, income, poverty, marital status, education and more. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. 0%, 2.75%, 3.68% and 3.75%. Browse the granville, oh property tax rates on our tax rates tables and learn more. Granville Ohio Income Tax Rate.

From oh-us.icalculator.com

Ohio Tax Tables Tax Rates and Thresholds in Ohio Granville Ohio Income Tax Rate These rates are for income earned in. Census data for granville, oh (pop. The village of granville will follow the federal and state of ohio in extending the due date for all granville income tax. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Browse the granville, oh property tax. Granville Ohio Income Tax Rate.

From www.creditkarma.com

Ohio Tax Rates Things to Know Credit Karma Granville Ohio Income Tax Rate The state has four tax rates: Census data for granville, oh (pop. 0%, 2.75%, 3.68% and 3.75%. Granville residents must report 100% of. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. These rates are for income earned in. Ohio state income tax brackets depend on taxable income and residency. Granville Ohio Income Tax Rate.